Big news for WA estates: Increased legacy amounts for intestacy from 5 July 2025

There has been a significant update in estate law, with the WA Government announcing an increase in the statutory legacy amounts for intestate estates – those where someone passes away without a valid Will.

Back in March 2022, the Administration Act 1903 (WA) was amended to modernise inheritance entitlements for spouses, children, and other family members. One of the key reforms was the introduction of a mandatory review of these amounts every two years.

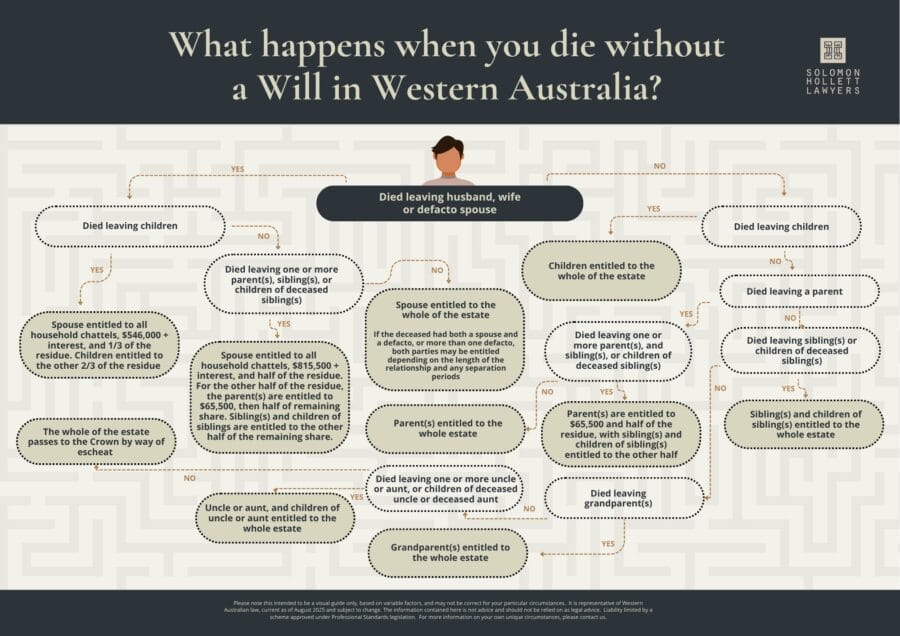

As a result of the latest ministerial review, the new legacy amounts (effective from 5 July 2025) are:

- $546,000 for a surviving spouse or de facto partner where there are also surviving children (up from $501,000)

- $815,500 for a surviving spouse or de facto partner where there are no surviving children (up from $748,500)

- $65,500 for surviving parent/s (up from $60,000)

To help explain how estates are distributed when someone dies without a Will in WA, check out our updated Intestacy Flowchart here:

These increases are a welcome improvement for families navigating the loss of a loved one, but they don’t make intestacy (dying without a valid Will) any more of an attractive option. Without a valid Will, your estate is divided according to a rigid legal formula — one that rarely reflects your personal wishes.

Having a proper Will remains critical to put in place your specific wishes and plans, instead of having your estate carved up according to a rigid formula. Distributions in the case of an intestacy will almost never match the desired outcome for your beneficiaries, and you have no say over how your wealth will pass to them. Plus, the extra costs and complexities of administering an estate without a Will is guaranteed to take its toll on those left behind.

If you’ve been thinking about your Will or need help getting your affairs in order, there’s no time like the present – your loved ones will thank you one day.

Get in touch with us today and let us help put your wishes in place.

Brigitte was always meant to be at Solomon Hollett – so much she finds herself with her name on the front door, despite being no relation of Craig’s! Estate planning has been a common thread throughout her career. Before joining SHL, she focused on Wills and succession work, after having spent time in other roles within the trusts, estate planning and administration space, and some commercial and migration law. She has worked for professional trustee companies, smaller boutique firms and practices across a range of clients and wealth brackets. Her love for estate planning centres on getting to know clients and what really drives them, their family dynamics, goals and values. There are many interesting and tricky conversations, lots of “option-storming” and ultimately finding solutions that never look the same as the next matter given no two families are ever the same. Spending time with her two young children and husband is what Brigitte enjoys most, alongside culinary pursuits at home and sampling new restaurants. Ever since she can recall Brigitte has loved reading, analysing, language and writing, going so far as pulling together a fairly large, somewhat cryptic collection of poems that we will be strongly encouraging her to publish!